Rules based vs. Principles based approaches to Corporate Governance

At global level, there are approximate 409 corporate governance codes are designed by various countries and authorities. But we can say the code can be either based on Rules or it can be guiding principles.

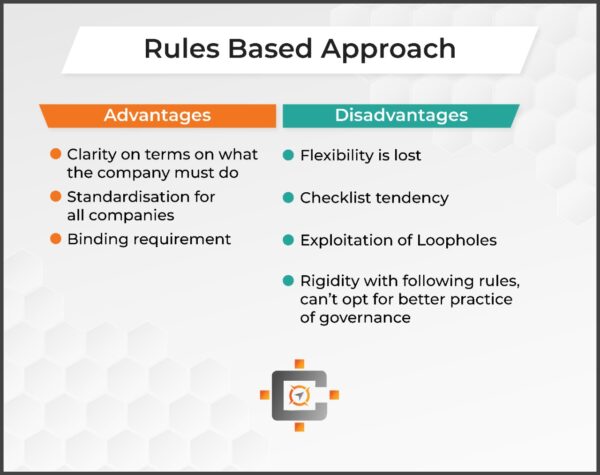

A rules-based approach instils the code into law with appropriate penalties for transgression.

A principles-based approach requires the company to adhere to the spirit rather than the letter of the code. The company must either comply with the code or explain why it has not through reports to the appropriate body and its shareholders.

The UK model is a principles-based one.

The US model is enshrined into law by virtue of SOX. It is, therefore, a rules-based approach.

US Sarbanes Oxley Act, 2002

SOX is a rules based approach and extremely detailed. It is relevant to US companies, directors of subsidiaries of US Listed business and auditors who are working on US Listed businesses.

Below are some SOX Specific Provisions:

- The establishment of Public company accounting oversight board.

- Auditor should review internal control systems.

- There should be rotation in senior audit partner in every five years to avoid familiarity threat.

- Auditors are prohibited from carrying out non audit service.